Saving money in 2025 is smarter and easier than ever with digital tools and high-yield financial products. From AI-driven budgeting to passive income streams, this guide covers the top saving hacks to maximize wealth and financial security.

Learn the best saving strategies in 2025, including high-yield savings accounts, automated budgeting apps, and smart investment techniques.

Introduction: The Importance of Smart Saving in 2025

With rising inflation and changing economic trends, saving money effectively is more crucial than ever. Smart financial habits can help individuals build long-term wealth while maintaining financial security.

2. High-Yield Savings Accounts – Maximizing Your Idle Cash

Traditional savings accounts offer minimal interest, but high-yield savings accounts provide better returns. Online banks and fintech platforms now offer rates above 4%, making them an excellent place to store emergency funds.

3. Budgeting Made Easy – AI and Automation in 2025

AI-powered budgeting apps like Mint, YNAB, and Cleo analyze spending habits, automate savings, and provide personalized recommendations to improve financial management.

4. Cash-Back and Rewards Programs – Smart Spending for Extra Savings

Using cash-back credit cards, digital coupons, and reward programs like Rakuten and Honey can help maximize savings on everyday purchases.

5. Investing Spare Change – Micro-Investing Apps for Wealth Growth

Apps like Acorns and Stash round up daily purchases and invest the spare change into diversified portfolios, helping users save and grow money effortlessly.

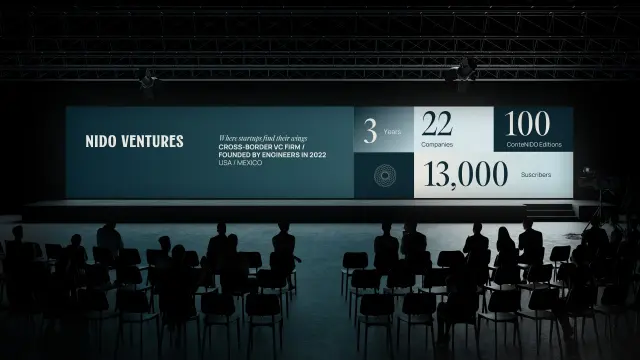

6. Passive Income Streams – Earning While You Save

Creating passive income through dividend stocks, real estate crowdfunding, or affiliate marketing allows individuals to save money while increasing their earnings.

7. Debt Reduction Strategies – Paying Less Interest, Saving More

Consolidating high-interest debt, refinancing loans, and using the debt snowball or avalanche method can help reduce financial burdens and increase savings potential.

8. Grocery and Lifestyle Savings – Cutting Unnecessary Expenses

Meal planning, buying in bulk, and using subscription-tracking apps like Truebill help eliminate unnecessary expenses and optimize monthly budgets.

9. Automating Savings – Setting and Forgetting for Future Wealth

Setting up automatic transfers to savings accounts ensures consistent contributions and reduces the temptation to spend extra cash.

10. Retirement Contributions – The Power of Long-Term Growth

Maxing out contributions to 401(k)s, IRAs, and HSAs provides long-term savings benefits, tax advantages, and secure financial futures.

11. Tax-Efficient Saving Strategies – Keeping More of Your Money

Utilizing tax deductions, investing in tax-advantaged accounts, and understanding tax credits can significantly impact long-term savings.

12. Conclusion: A Smarter Approach to Saving in 2025

By leveraging modern financial tools, high-yield accounts, and strategic investment methods, individuals can grow their wealth faster while maintaining financial stability.